US Default Inevitable

#11

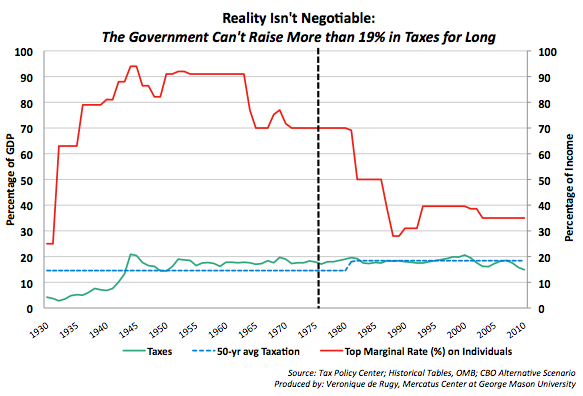

The simple fact remains that the government cannot change the top marginal tax rate enough to net greater than about 19% of GDP in revenues. This has been true for the last 80 straight years:

http://mercatus.org/...e-19-taxes-long

From 1930 to 2010, tax revenue collection in the United States has never topped 20.9%, averaging 16.5% of GDP over these 80 years. This comes despite the drastic historical fluctuation in the rate of taxes on the wealthiest Americans.

The real issue is not taxation, but spending. Put into terms of a typical household, if the US goverment earned $50k per year in tax revenue (roughly the average for a US household):

- It is $325k in debt

- It pays almost $10k per year in interest

- Last year, it spent $79k

- This year, it hopes to spend $86k

#12

Contributors

Join Date: May 2009

Location: SoCal

Posts: 10,496

Likes: 0

Received 2 Likes

on

2 Posts

My Ride: 2008 550I LOADED, all options except HUD and NV

However, your figures fail to face the fact that when tax rates are higher on the top 1-2% of earners the overall economy is healthier - case in point, the 50's (generally seen as the Golden Era in American history), by your own chart and by fact the top tax rate was 91%(under Ike - a Republican president no less, go figure). The wealthy paid more taxes in the 90's - boomtime. Interesting isn't it? The Republican fallacy of lower tax rates on the rich create jobs, when every economist on the globe says different, proves again to be BS.

#13

However, your figures fail to face the fact that when tax rates are higher on the top 1-2% of earners the overall economy is healthier - case in point, the 50's (generally seen as the Golden Era in American history), by your own chart and by fact the top tax rate was 91%(under Ike - a Republican president no less, go figure). The wealthy paid more taxes in the 90's - boomtime. Interesting isn't it? The Republican fallacy of lower tax rates on the rich create jobs, when every economist on the globe says different, proves again to be BS.

No, that's merely taking a small slice out of the total data and merely mistaking correlation for causation.

Again, it's a problem with either misunderstanding the laffer curve or not knowing about it at all.

Everything is about incentives. Folks from every earning level follow this. The higher the tax rate, the less likely folks will be to put the extra effort in to earn and more into hiding or moving money into protected accounts. Those at the top tax bracket have the most ability to do this. In the 50's, the middle class paid a far higher percentage of the total tax revenue than they do now because much less money came in from the top bracket.

I'm sure if the marginal tax rates at the top were returned to the 90% range, you'll find the middle and lower classes whining about having to pay FAR more taxes than they do now, to cover the drop in revenues from the top.

Can the top marginal tax rate be raised high enough to cover goverment spending? Sure in the liberal imagination-land where the top tax rate is 134% of earnings and that doesn't change the behavior of anyone in that bracket. Of course, no one on the left seems to have a problem ignoring economic realities in their desire to "soak the rich."

#14

Contributors

Join Date: Jan 2005

Location: San Jose, California, USA

Posts: 4,119

Likes: 0

Received 0 Likes

on

0 Posts

My Ride: 2008 Porsche 911 Carrera S Convertible. Midnight Blue, 6 Speed.Retired - 2007 997 Carrera S, Midnight Blue, Grey leather, premium audioRetired - 2007 550i, Monaco Blue over Beige, Navigation, Logic 7, Cold Weather Pack, Comfort Access, Sport Package

Model Year: 2008

The real issue is that too many in the US pay too little or pay no tax. As an "average" earner, you're looking at an effective rate that's in the single digits, often lower than 5% and often close to zero.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

#15

Contributors

Join Date: Aug 2008

Location: Zoo York

Posts: 9,986

Likes: 0

Received 0 Likes

on

0 Posts

My Ride: Alpine White 2006 530Xi (SLD)

"It's inevitable that the U.S. will default?it's essentially an empire which is overextended and in decline?and that its financial system will go with it,"

#16

Contributors

Join Date: Nov 2004

Location: NYC & LI

Posts: 2,460

Likes: 0

Received 0 Likes

on

0 Posts

Wounds are still fresh from the damage that the prior administration caused to the economy and there isn't anything close to a clearly electable candidate in the current GOP group that have shown their hand. Furthermore, it's pretty clear that the GOP strategy is to prolong the current problem hoping it will extend to closer to election time. It is easy to criticize and talk about this not being the kind of change that Obama promised. The reality is that Obama's job has been made much more difficult by the GOP's obstructionism and seemingly their willingness to put the economy at risk to score political capital - while doing their utmost to prolong and not resolve the problems. Frankly, it's remarkable what has been done given the climate within which the administration is operating. Either way, I've yet to see a credible alternative to Obama and perhaps that is why he remains the more likely winner in 2012.

Its up to the current adminstration to build a path to the answer to resolve this, not the congress, but our leader is more of an outsourcer than the Corporate "fat cats" that he so often calls out.

But, its still early in the election cycle, there is no way Obama is winning with 9%+ unemployment, some one, some where that is not a lightning rod will come in and hopefully offer some realistic way out. We certainly need a change from alll this "change"

#17

Contributors

Join Date: May 2009

Location: SoCal

Posts: 10,496

Likes: 0

Received 2 Likes

on

2 Posts

My Ride: 2008 550I LOADED, all options except HUD and NV

The real issue is that too many in the US pay too little or pay no tax. As an "average" earner, you're looking at an effective rate that's in the single digits, often lower than 5% and often close to zero.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

I can agree Steven, however, extending the tax cuts - ostensibly so that the wealthy and corporations "feel freer to create jobs", is a ridiculous myth as well.

How about instead of cutting things like the EPA, heating subsidies for the poor, and Planned Parenthood they do away with things like farm subsidies. Since most farms are large corporate operations now it seems silly to be giving a multi-billion dollar subsidy to them, doesn't it?

I am also fine with paying taxes, I pay my fair share - that's for sure. I'd certainly be in favor of eliminating a lot of the loopholes instead of a tax increase. Republicans always complain that the corporate tax rate is too high for America to be competitive, BS!!!! How many companies actually pay that higher rate? Certainly not GE, who not only didn't pay any taxes on $14.8 Billion in profits, they got a $3 billion refund - WTF?!?!?! And still they have the nerve to ask "where did the money go?"

#18

Contributors

Join Date: Nov 2004

Location: NYC & LI

Posts: 2,460

Likes: 0

Received 0 Likes

on

0 Posts

The real issue is that too many in the US pay too little or pay no tax. As an "average" earner, you're looking at an effective rate that's in the single digits, often lower than 5% and often close to zero.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

The "soak the rich" mentality is sorely misplaced - the only moderately wealthy are already paying way more tax, in absolute and relative terms, than the vast majority of the population. At just 375K in AGI you're at a marginal 35%, never mind the probable sojourn into AMT and its additional tax cost through the elimination of certain deductions.

I'm generally extremely liberal on most matters but the concept that the moderately wealthy or higher earners don't pay enough tax is ludicrous.

I am happy to pay tax, I have no problem getting taxed more than most - but right now, we need to cast the tax net wider. The bottom line is that too many pay too little.

Also, as pj pointed out above, our congress had failed us greatly, as the GE story proves. And for those that dont know, GE is the liberal fat cats not the conservative types, and still are enriched by taking jobs and profits away from the US. I believe that it should be illegal have these offshore shell companies allowed to go around tax liabilities, but GE has fought hard and spent serious dollars getting those necessary reps elected to ensure that they have the laws passed to allow them to escape. Same goes for the outsourcing bs, we give tax credits to companies to move jobs offshore to india and china and the phillipines, and restrict what companies can do in the US with policies such as the health care debacle and high taxes. You think they would offer tax credits greater in value for creating jobs in the US and penalize those who move them offshore, you think that would have been a worthy cause for the president and the dems to fix in the first 2 years on the job, but they just continued the practice and increased the credits to offshore. We have lots of problems with our system, its certainly broken, and it starts with each and every elected official, I loathe them all.

#19

Contributors

Join Date: May 2009

Location: SoCal

Posts: 10,496

Likes: 0

Received 2 Likes

on

2 Posts

My Ride: 2008 550I LOADED, all options except HUD and NV

This is absolutley part of the problem and could be part of the solution, though the class warefare employed by the admin make it impossible. If the stats show that approx 50% of the country pays no Fed taxes into the system, just think if they even paid $500 to $1000 a year, how much money over a decade could be dedicate to debt relief. We're talking hundreds of billions to trillions of dollars that are needed. I also think that we need to redefine what it means to be wealthy, because what the politicians define as such is lunacy. A couple making $250K in NY and LA and other large expensive metro areas are not wealthy by any stretch of the imagination. I know this offends many people to read, hear, and try to believe, but the cost of living is so high in our metro areas that there needs to be a different approach. I agree that most moderatly weathly people pay their fair share, but I believe that the really wealthy can certainly pay more. The billionaires need to be taxed in a different manner than the rest of us, they are never going to spend all that money, and its our system and way of life that allowed them to earn such vast fortunes. A combination of ideas needs to come together.

Also, as pj pointed out above, our congress had failed us greatly, as the GE story proves. And for those that dont know, GE is the liberal fat cats not the conservative types, and still are enriched by taking jobs and profits away from the US. I believe that it should be illegal have these offshore shell companies allowed to go around tax liabilities, but GE has fought hard and spent serious dollars getting those necessary reps elected to ensure that they have the laws passed to allow them to escape. Same goes for the outsourcing bs, we give tax credits to companies to move jobs offshore to india and china and the phillipines, and restrict what companies can do in the US with policies such as the health care debacle and high taxes. You think they would offer tax credits greater in value for creating jobs in the US and penalize those who move them offshore, you think that would have been a worthy cause for the president and the dems to fix in the first 2 years on the job, but they just continued the practice and increased the credits to offshore. We have lots of problems with our system, its certainly broken, and it starts with each and every elected official, I loathe them all.

Also, as pj pointed out above, our congress had failed us greatly, as the GE story proves. And for those that dont know, GE is the liberal fat cats not the conservative types, and still are enriched by taking jobs and profits away from the US. I believe that it should be illegal have these offshore shell companies allowed to go around tax liabilities, but GE has fought hard and spent serious dollars getting those necessary reps elected to ensure that they have the laws passed to allow them to escape. Same goes for the outsourcing bs, we give tax credits to companies to move jobs offshore to india and china and the phillipines, and restrict what companies can do in the US with policies such as the health care debacle and high taxes. You think they would offer tax credits greater in value for creating jobs in the US and penalize those who move them offshore, you think that would have been a worthy cause for the president and the dems to fix in the first 2 years on the job, but they just continued the practice and increased the credits to offshore. We have lots of problems with our system, its certainly broken, and it starts with each and every elected official, I loathe them all.

My GE example was one of many, and it has nothing to do with party affiliation. The oil companies have been raking in record profits, not just for them but for ANY company ever in the history of the world. Why is it they still get government subsidies? Is that effective use of taxpayer dollars? I am not a fan of any kind of welfare, but much less so for corporations, especially the ones making gobs of money and having no iuse for them.

I don't think "redistribution of wealth" is the solution to the current economic crisis. History does make clear, however, that when the middle class (yes if you make $250k a yr you are middle class) has more money in hand they spend more and the economy booms. Whereas, history also proves (along with every economist alive) that the very wealthy having more money does nothing for the overall livelyhood of the country, they tend NOT to spend.

As you can see the problem with big business is nothing new, the players have changed, but the Robber Barons of old are back:

"We demand that big business give the people a square deal; in return we must insist that when anyone engaged in big business honestly endeavors to do right he shall himself be given a square deal."

Letter to Sir Edward Gray, November 15, 1913

#20

Contributors

Join Date: Nov 2004

Location: NYC & LI

Posts: 2,460

Likes: 0

Received 0 Likes

on

0 Posts

Agree on the corp welfare too, no Oil subsidies, no ethanol subsidies, and any other such situations where record profits are being cashed into bonuses for those CEOs. I just point out GE as well since they are so smug, and the fact that Imelt is the presidents point person on job growth in the US is laughable if not so tragic.